Respectfully submitted by Karin Reinhold

With data and advise from Paul Frament

Treasurer’s Comments

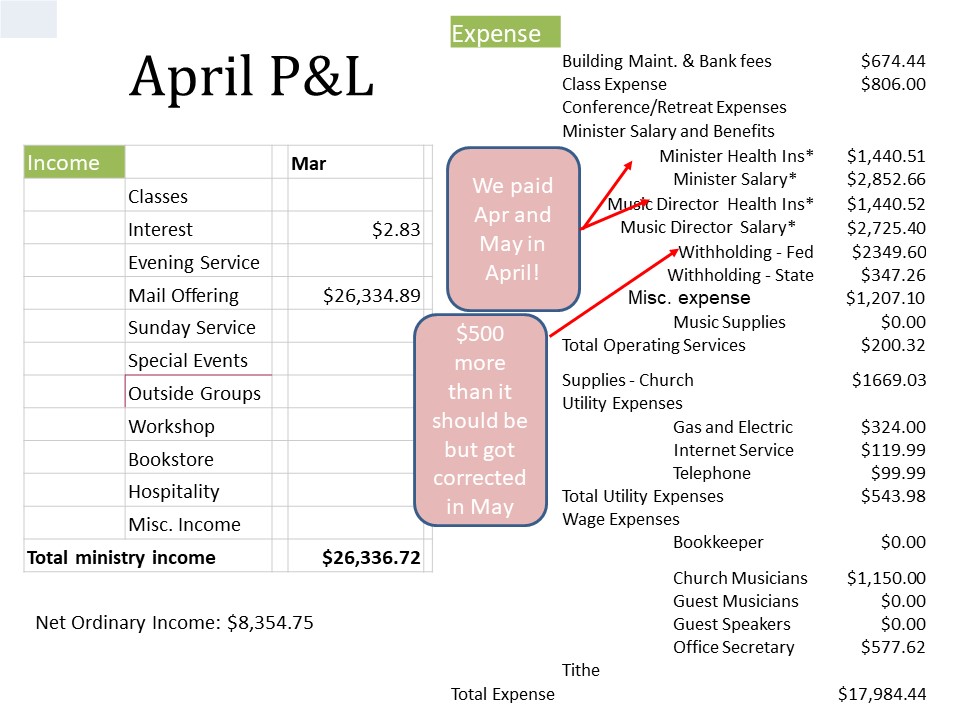

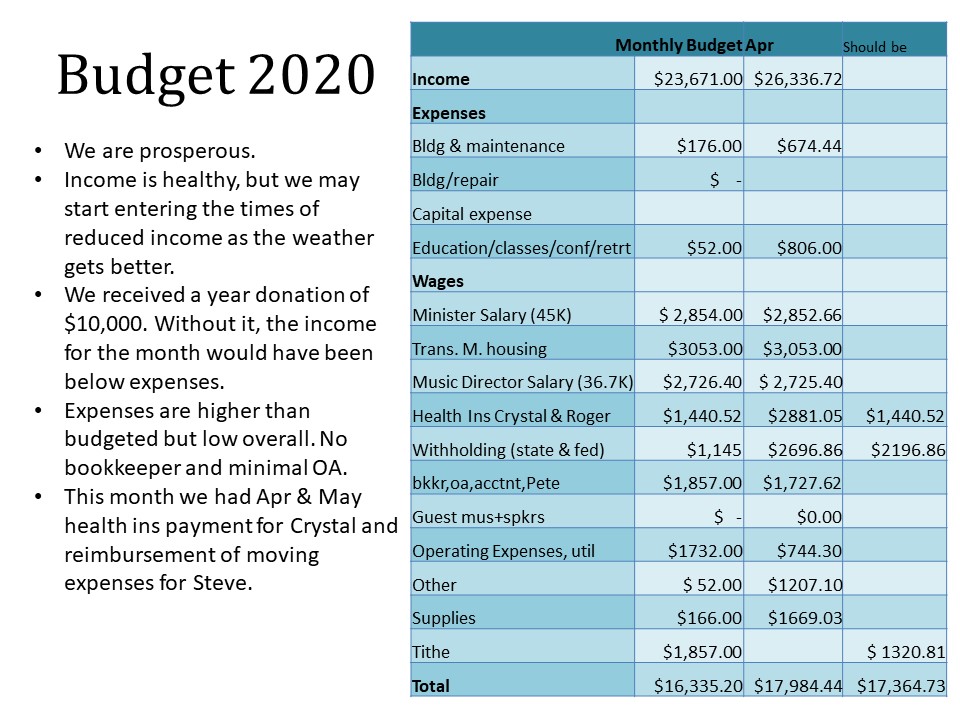

- Regular love offerings were somewhat down, but we received special one-time generous donations in April ~ 10K + 2K

- We are spending more than projected numbers from 2020 budget. This month we made 2 health payments for Crystal (last one in July) and for Roger (April and May) and Steve’s relocation expenses.

- We still haven’t paid the tithes

- Our investments were reassessed, and we’ll keep a conservative strategy.

- Sources of expenses to account for:

–We need to pay our tithes for Jan, Feb. , Mar. & Apr. We are in good financial position to be able to do that.

–Hiring of a new bookkeeper and office assistant.

- A reduction of expense: June will be the last payment for health insurance for Rev Crystal (July invoice).

Investment Update

- Our investments increased last year with a bull market. Right now we are experiencing the opposite:

–Original investment was $180,000 (5 years ago)

–Balance Feb 2020: $ 195,596.56

–Balance Mar 31, 2020: $184,344.66

–Balance Apr 30, 2020: $191,871.95

Dividends: $362.53

During April the account gained $7,527.29 due to market bouncing back a bit.

Assets

Checking/Savings

CAPCOM Checking $ 34,794.81

CAPCOM Money Market $ 11,947.44

CAPCOM SAVING $ 4,301.76

Total Checking/Savings $ 51,044.12

Investment:

CDC Loan Fund $20,000.00 Community Loan Fund

Merrill Lynch $191,871.95

Total Investments $211,871.95

TOTAL ASSETS $262,916.07

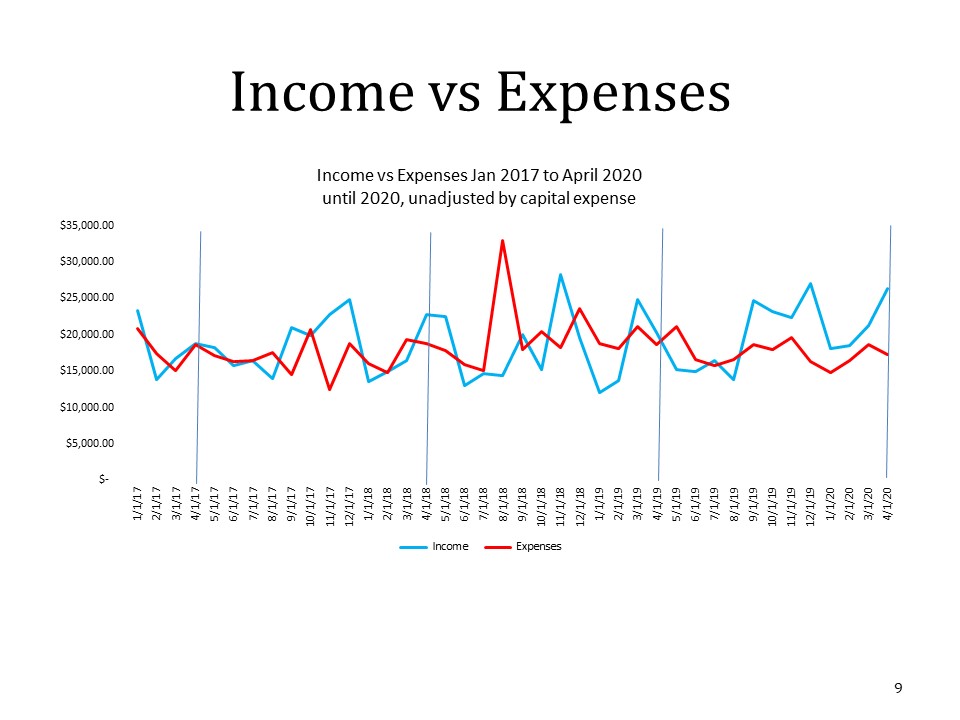

CHARTS