Respectfully submitted by Karin Reinhold

With data and advise from Paul Frament

Treasurer’s Comments

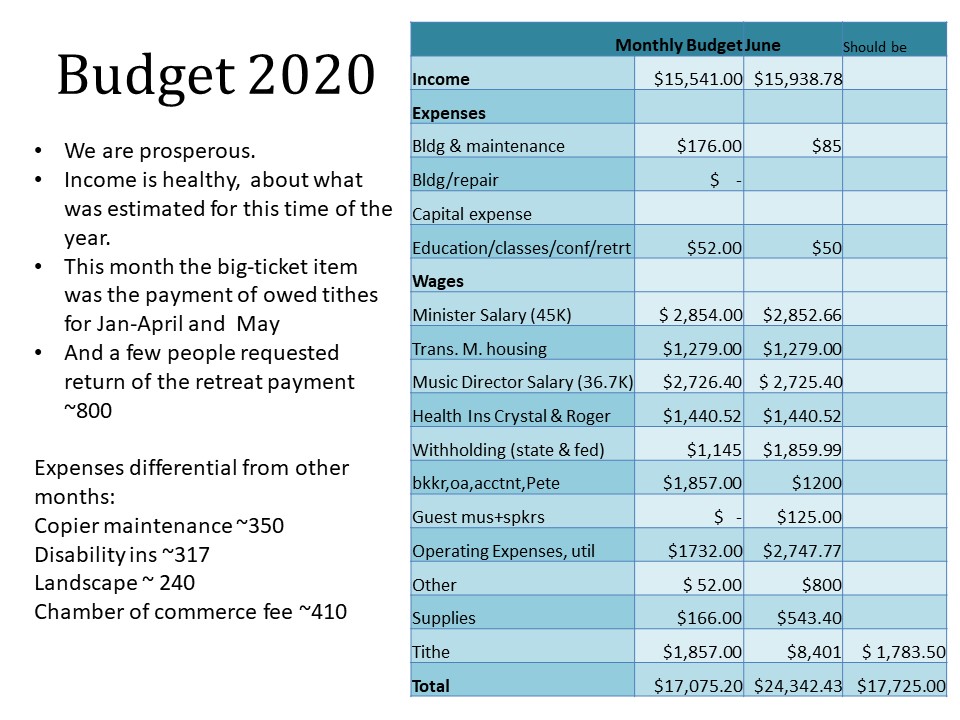

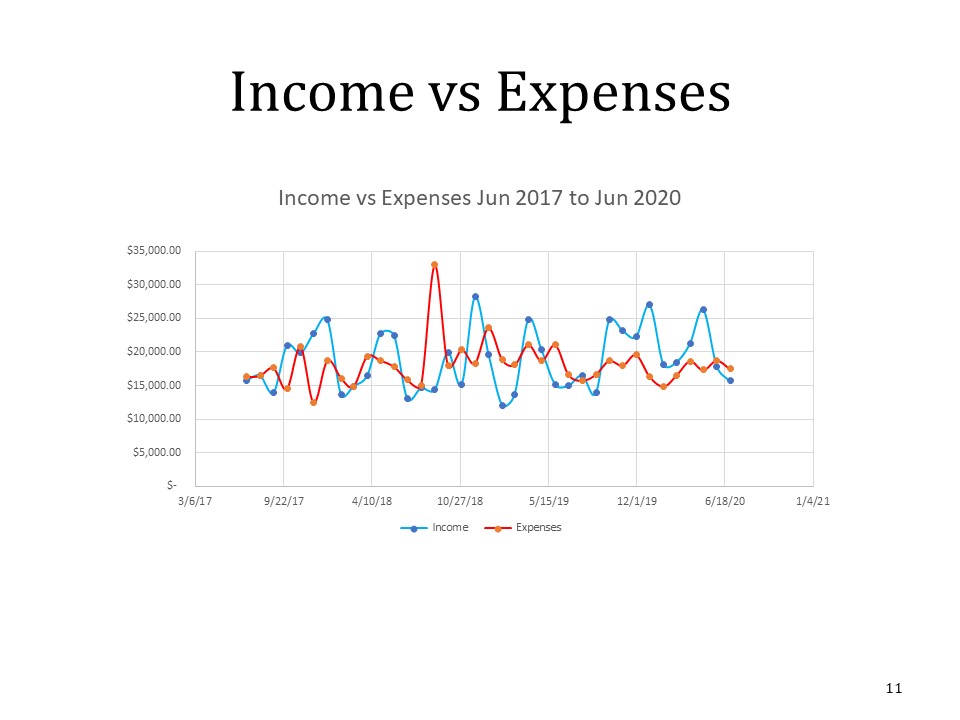

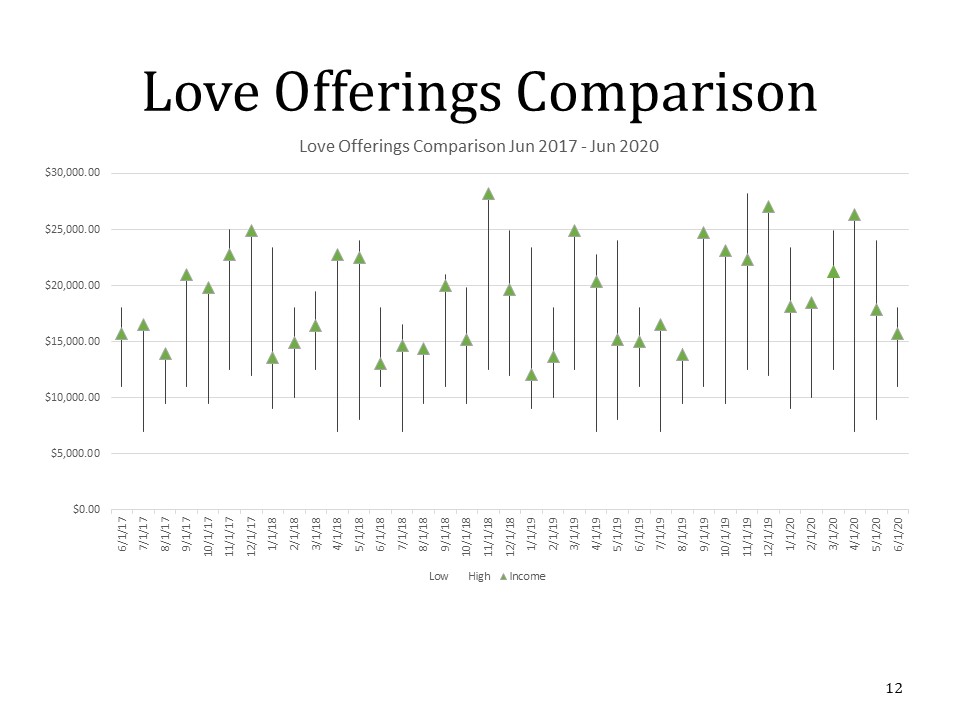

- Love offerings are around the estimated average for summer months (as calculated by Rob Geyer’s Budget which averaged several years). They are lower than our expenses. But this is a seasonal occurrence. We are in the Doldrums of Summer and it might get a little scary to see checking account balances go down. However, we have had a good year so far, and looking backwards, we are in a better financial situation than last year. So we continue affirming that we are prosperous and we are in the loving hands of God.

- Expenses have shifted, as noted in previous report. We have more expenditures to maintain online presence and communication (Zoom, website management and Dropbox)

- Going forward we’ll have additional expenses from bookkeeping & office assistant.

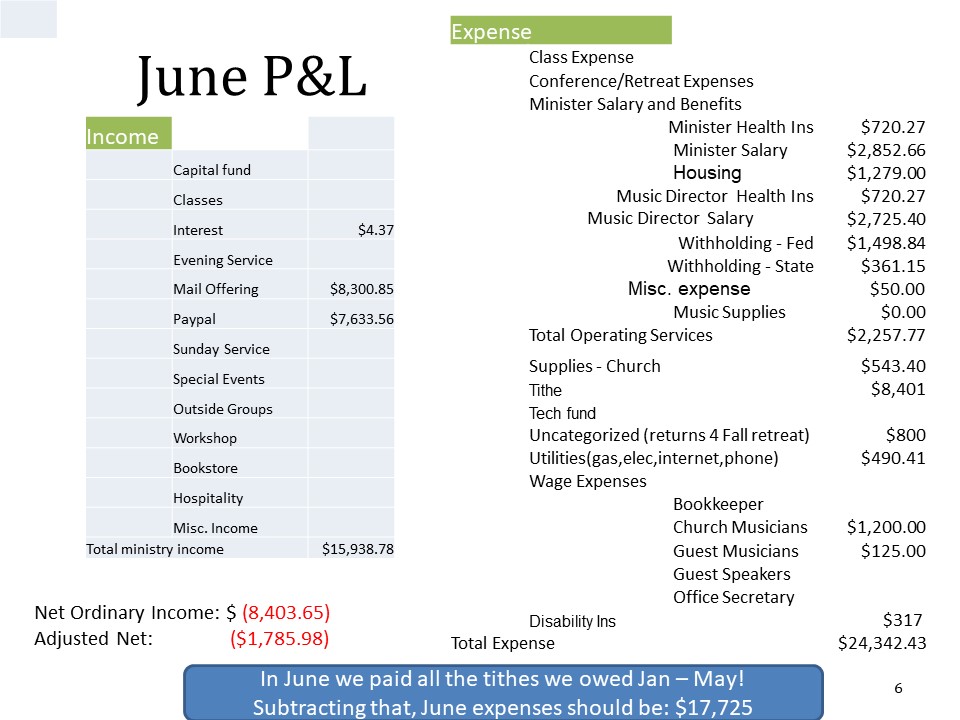

- Big ticket item this month: Tithes. In June, we paid tithes for the months of Jan to May.

- June was the last payment for health insurance for Rev Crystal (July invoice). From now on, and up to 1.5years, Rev Crystal will be sending the health insurance payment and we’ll pay it on her behalf. That is the way it works with the Chamber of Commerce – COBRA. In July, Rev Crystal sent the corresponding health ins. Funds.

- Paypal: fees are 2.9% + .50 per transaction. I’m working on getting a non-for-profit designation to reduce fees to 2.2%.

Differences with P & L

- My reports differ from the P&L reports in two ways:

–P&L records the NET amounts from Paypal, I account for GROSS = NET + fees

–Health insurance payments appear on the month of coverage. (In the P&L they appear on the month paid. Sometimes we paid 2 consecutive ones in the same month, but I like to account these expenses for the month they were spent)

Investment Update

–After a jittery market, our investments are back around to where they were at the beginning of the year. Original investment was $180,000 (5 years ago)

–Balance Feb 2020: $ 195,596.56

–Balance Mar 31, 2020: $184,344.66

–Balance May 31, 2020: $195,704.33

Dividends: $280.25

During May the account gained $3,552.13 due to market bouncing back a bit.

Assets

Checking/Savings June 30, 2020

CAPCOM Checking $24,432.76

CAPCOM Money Market $11,950.54

CAPCOM SAVING $4,302.12

Total Checking/Savings $ 40,685.42

Investment:

CDC Loan Fund $20,000.00 Community Loan Fund

Merrill Lynch $197,588.36

Total Investments $217,588.36

TOTAL ASSETS $258,273.78